What is Tokenomics?

Tokenomics, or token-economics, is defined as the economic incentive models, including distribution and rewards, created within a blockchain through the use of tokens or cryptocurrencies.

Typically, the purpose of a token within a dApp or a blockchain network is to incentivize a set of actions that lead to desired outcomes.

These outcomes can include:

- The usage of a product

- The trading of goods and services

- The sharing of information across a user's network

- The validation of transactions

The basic assumption is that users are more likely to engage in certain activities if they can be rewarded with tokens that hold some kind of monetary value.

These users might already be engaging in these activities for free or might have never considered these activities prior to the token incentive model existing. With the exception of staking to validate transactions, you generally want to incentivize actions that your target users are already doing for free, or are at least familiar with.

Actions to incentivize could include:

- Playing a game

- Borrowing from a lending protocol

- Providing liquidity

- Promoting something on social media

The more familiar the task, the more likely you will attract users who actually have a genuine interest in your product or service beyond the token incentive model.

Tokenomic Models

While tokenomic models may differ between blockchains, there is a common set of models that have been adopted by blockchains like Bitcoin, Ethereum, Cardano and others.

The Deflationary Model

In a deflationary model, tokens have a maximum supply that is never increased, or make use of a ‘burn mechanism’ in order to decrease supply overtime by purchasing their own tokens and sending it to a one way wallet address.

You can think about this like share buybacks.

Examples of cryptocurrencies that are deflationary include:

- Bitcoin

- ZEN

- BNB

BNB is a token that is deflationary and also uses a buy and burn mechanism to decrease supply over time.

A deflationary model is the preferred model for founders that:

- Want to create a token that can be adopted as a store of value or a form of pristine collateral for borrowing and lending.

While limiting or reducing the supply of a token may increase its value in the short term, it often has the effect of reducing people's willingness to spend it, as they assume the token will continue to appreciate in value and therefore do not wish to trade it for a potentially depreciating asset.

The Inflationary Model

In an inflationary model, tokens increase in supply over time based on rules established by an algorithm or through factors such as supply and demand.

Examples of those using an inflationary model include:

- ETH

- SOL

- ATOM

An Inflationary model is the preferred model for founders that:

- Wish to have their token be adopted as a transactable currency rather than a store of value.

The steady increase in supply discourages users from hoarding their tokens and instead encourages spending or putting the tokens to work in other ways like staking, investing, etc, in order to generate more tokens at a rate that beats the inflation rate.

This model more closely resembles that of fiat currencies, with the exception that levers for determining token inflation are written and executed by open source computer code, making it more transparent than central bank monetary policy.

The Dual-Token Model

In the dual-token model, two tokens exist within a single blockchain. The most common variation of this is when one token serves as a store of value while the other has a utility function such as a medium of exchange.

Examples of those using a dual-token model include:

- Terra - LUNA/UST

- VeChain - VET/VTHO

- Ontology - ONT/ONG

The Asset-Backed Model

In an asset-backed model, a token is backed by underlying assets, such as fiat currencies, commodities or other cryptocurrencies.

Examples of those using an asset-backed model include:

- Tether - USDT

- Dai - DAI

The Bonding Curve Model

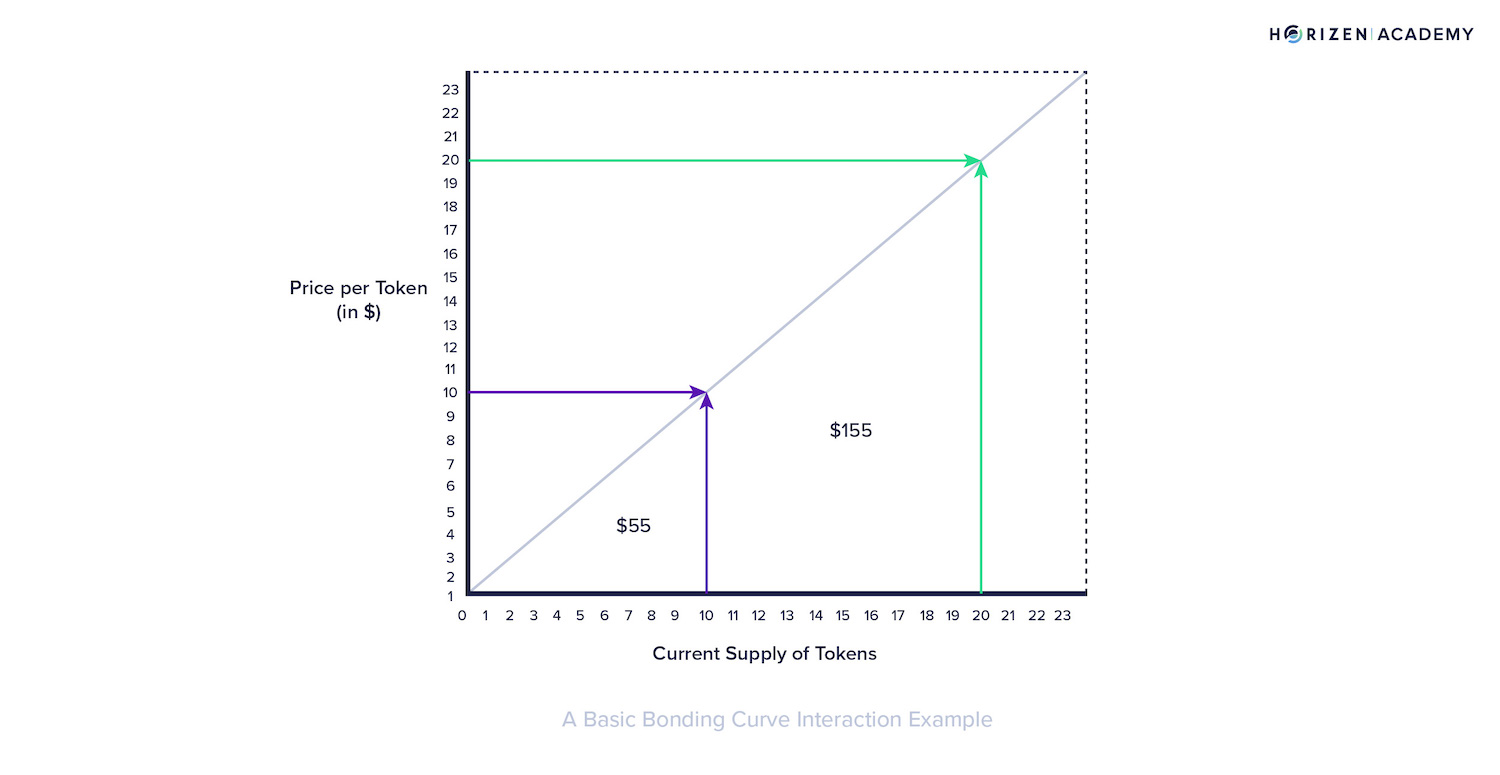

The bonding curve model uses a mathematical formula to establish a predictable relationship between a tokens price and supply.

With bonding curves, the price and supply of the token is set by the smart contract. As more people buy the token, it automatically mints additional tokens while incrementally increasing the price for the next buyer.

As people sell the token, the opposite occurs; the contract sets the price incrementally lower for the next seller while also reducing the supply.

The benefit of bonding curves is that they allow developers to establish more control and orderliness over how their token is valued in the market. As opposed to relying strictly on supply and demand, which can lead to higher levels of volatility that is detrimental to creating a relatively stable and usable digital currency.

Types of Actions to Incentivize

Before designing your tokenomics model, it’s important to first outline the type of actions you are trying to incentivize, as this will enable you to design a model that best fits your goals.

There are 3 main reasons to create a token:

- Product or Network Adoption

- Fundraising

- Transactable Currency

Each of these reasons comes with their own set of unique actions that we can incentivize through our tokenomics model.

For example, if you are creating a token to spur adoption of a product or network, your tokenomics should be designed in such a way that links usage of the token intrinsically with usage of the product. Then, reward users of the token with some combination of more tokens or other benefits tied to increase use of the product/network .

The best example of this is staking rewards that are earned by those who validate transactions on a proof of stake blockchain.

Here, the ‘product’ is the network, and one of the ways to use the network is to become a validator, which both requires tokens and rewards tokens. Setting transaction fees that are denominated in your token is another way to link token usage with product usage.

If your product is a web3 game, you can require users to purchase certain in-game NFTs that are priced on the token in order to play the game.

You can then reward users who win levels in the game or unlock certain achievements with newly minted tokens. This ensures that a dedicated subset of token holders will be using the token for the purpose of playing the game rather than just as a speculative asset.

Of course in order for this to be sustainable, the game must provide more entertainment value to the user than whatever monetary value they can extract from the tokens earned.

Token Distribution

Distribution is critical to design your tokenomics.

Token distribution involves how you distribute the token to founders and team members, as well as how you make it more accessible for new users to purchase and trade it.

Team Token Distribution

When it comes to team distribution, you need to identify how much of your tokens total supply should go towards key team members who will provide maximum value.

This includes team members in engineering, business development and marketing. For marketing, you might find it useful to allocate a portion of tokens to external partners who can give you access to their audience.

Distributing tokens to team members must be done slowly and based on a set schedule to ensure that they are properly incentivized to stick around and help you build or grow the project.

If too many tokens are granted to team members prior to the project achieving important milestones, the incentive to achieve those milestones could be minimized. It would also raise concerns amongst holders of the token that the team is not serious about building the project for the long term.

It’s also important that whatever distribution schedule you create is made transparent to the public and that the actual act of sending tokens to team members is done via smart contracts.

This will allow holders of your tokens to have more trust in your team.

End User Token Distribution

For distributing tokens to end users, the goal should be to make it as easy as possible for users to access and trade your token in order to maximize adoption.

You should focus on maximizing token distribution by providing liquidity on decentralized exchanges and by forming strategic partnerships with wallets, centralized exchanges and even vendors who may be willing to accept your token as a currency.

Token Supply Dynamics

Token supply plays an important role in terms of its price, its perception by market participants and its utility by users.

If you plan to make your token a transactable currency, it usually makes sense to create a larger supply because then you can price items in whole numbers rather than decimals.

An NFT with a price of 5 xyz tokens is easier for the average buyer to compute than one that has a price of 0.05 xyz tokens.

Tokens with a large supply like 1 billion+ tend to be priced lower, around $10 or less, while tokens with a low supply like 21 million are more likely to be priced higher, $100 or more.

Even though tokens are divisible, many investors tend to fall for ‘unit bias’.

Unit bias is the tendency to believe that a single unit of a token that is priced at $5, $1 or $0.50 is cheaper than a single unit of a token that is priced at $1,000 or $10,000, even though the total supply of each token may be completely different.

The phenomenon is most commonly noticed with cryptocurrencies like Dogecoin or tokens like Shiba Inu where the price is less than $1, yet the supply is over 1 billion.

By contrast, Bitcoin has a price of $19,000 (at the time of writing) but its supply is only 21 million.

Circulating Supply

Circulating Supply is the total supply that is currently trading on the market.

Think of this as the total amount of a token that anyone can currently buy on a DEX or CEX. The remaining supply that is not circulating is usually locked by project teams that plan to release it according to a schedule.

Team members will often have a large percentage of their tokens locked in a smart contract for a period of time as an incentive to continue working on the project, this is called a vesting schedule.

Oftentimes the non-circulating supply of a token slowly becomes circulating through staking or through fees earned from liquidity pools that are denominated in that token.

Maximum Supply

The maximum supply of a token that will ever exist.

When designing a token, you have the option to choose what the maximum supply will be from the beginning. Once this is chosen, it can never be changed.

Not every token has to have a maximum supply.

You can set your token to have an infinite supply that increases at a steady rate of 1 or 2% per year. This inflation based design will make your token function more like traditional fiat currencies do today.

One benefit of launching a token on a blockchain versus using central bank controlled fiat currencies is that you can set an inflation rate that is transparent for everyone to see and does not ever change. This gives users more trust in your token because they don’t have to worry about the creator changing the inflation rate down the road, which would affect their perception of the token's value and utility.

Token Price

The current trading price of your token.

Token prices are often denominated in dollars, but can also be denominated in Bitcoin or ETH.

Many investors like to track the price of a token in ETH or BTC terms to determine whether it has performed better than those assets in the market.

Market Capitalization

Market capitalization is equal to the circulating supply of a token multiplied by its price.

This gives you a good indicator of the current value of the project based on the available tokens that are trading on the market.

Fully Diluted Valuation

FDV is equal to the maximum supply of a token multiplied by its price.

This often gives you a more accurate reading on the value of a project because it shows you what the market is valuing the project if all of its tokens were currently available for trading.

Users will often compare circulating supply to maximum supply in order to gauge how much potential selling pressure will be placed on the token in the coming months or years.

For example, if a token has a circulating supply of 1 million but a maximum supply of 10 million, this can indicate that 90% of the token's supply will potentially be sold as soon as, or shortly after it becomes available for trading.

Investors evaluate this to determine how negatively it might impact the current price (it is often seen as a bearish indicator).

On the other hand, a token with a circulating supply of 9 million and a maximum supply of 10 million is likely already priced at exactly where the market thinks it should be relative to the additional 10% of supply that has yet to become available.

Users will also compare market cap and FDV in order to gauge whether a project's current valuations are realistic compared to more established projects.

A token with a circulating supply of 1 million and a maximum supply of 10 million will have an FDV that is 10 times higher than its circulating supply. So if the token price is $10, its market cap is $10 million, but its FDV is $100 million.

Users will typically compare this project to others that have an FDV of $100m and market cap closer to FDV to see if they stack up in terms of user adoption and network growth. If not, then they may be considered overvalued.

Token Issuance rate

Token issuance rate, or inflation rate, is the rate in which new supply of tokens are created or released unto the market.

Even though a low circulating supply to maximum supply ratio can send bearish market signals for the token price, it is often the most practical design to adopt for projects that need to leverage their token to create incentives for user adoption overtime.

In order to do this, many projects choose to keep a large percentage of the token supply locked so that they can release it slowly as rewards for yield farming, staking, earning through gameplay, etc.

However, just as important as understanding how circulating and maximum supply can impact price, one must also understand how the token issuance rate can impact price in the short term and long term.

If we take our example from earlier, a token with a circulating supply of 1 million and a maximum supply of 10 million might not be seen as bearish if additional 9 million tokens do not get released onto the market for the next 10-20 years.

However, if those same tokens are to be released to the market in 1 year, it would be seen as very bearish.

A slow issuance rate allows the market more time to absorb the selling pressure. If you flood users with too much of a supply of your token too soon, the signal you are sending to the market is that the token is of low value and should be sold as soon as it is acquired.

Designing Your Tokenomics

The general rule for building a sustainable Blockchain project and tokenomics model is to not issue more tokens in dollar terms than the dollars you earn as revenue.

This may not be achievable in the early days as you need to subsidize growth by rewarding more tokens to early adopters.

However, as your product grows in adoption, the total value of tokens rewarded for simply using the product should decrease to the point of being less than the revenue earned from the product, allowing you to continue rewarding users while maintaining a healthy profit margin.

When designing your own tokenomics, consider the following:

- Identify what type of action you want to incentivize

- Understand the various tokenomic models available to you

- Differentiate between a store of value and transactable currency use case

- Distribute tokens to founders and team members slowly and based on milestones in order to keep them incentivized to continue working on the project

- Devise way to maximize token distribution through liquidity provisioning as well as strategic partnerships with exchanges, wallets and vendors

- Design for long term sustainability over short-term growth