What is a Cold Wallet?

A cold wallet or hardware wallet is a type of wallet that lives on a hardware device like a USB and does not require a connection to the internet to function.

Cold wallets allow you to store, send and receive crypto assets just like a hot wallet, however with cold wallets, the user's private keys are stored offline.

Why Do We Need Wallets?

A wallet is essential for storing as well as sending and receiving cryptocurrencies.

Wallets contain your public key, which you send to people in order to receive crypto, like an email address, and your private key/seed phrase, which must be kept secret as it gives you access to your wallet and the ability to sign and authorize transactions.

Both your public and private key are necessary to give you the ability to hold, receive and spend your crypto while keeping it secure.

All of this functionality is made possible with a wallet.

Learning how to store your cryptocurrencies is one of the most important aspects of using a blockchain, especially as one starts to venture beyond using custodial wallets on a centralized exchange to interacting with dapps and DEXs, which require you to have a self custodial wallet.

Custodial wallets are wallets where the private keys are held by a centralized entity like an exchange or similar financial institutions. A self-custodied wallet is one where you hold your private keys and therefore have complete control over when and how you spend your crypto.

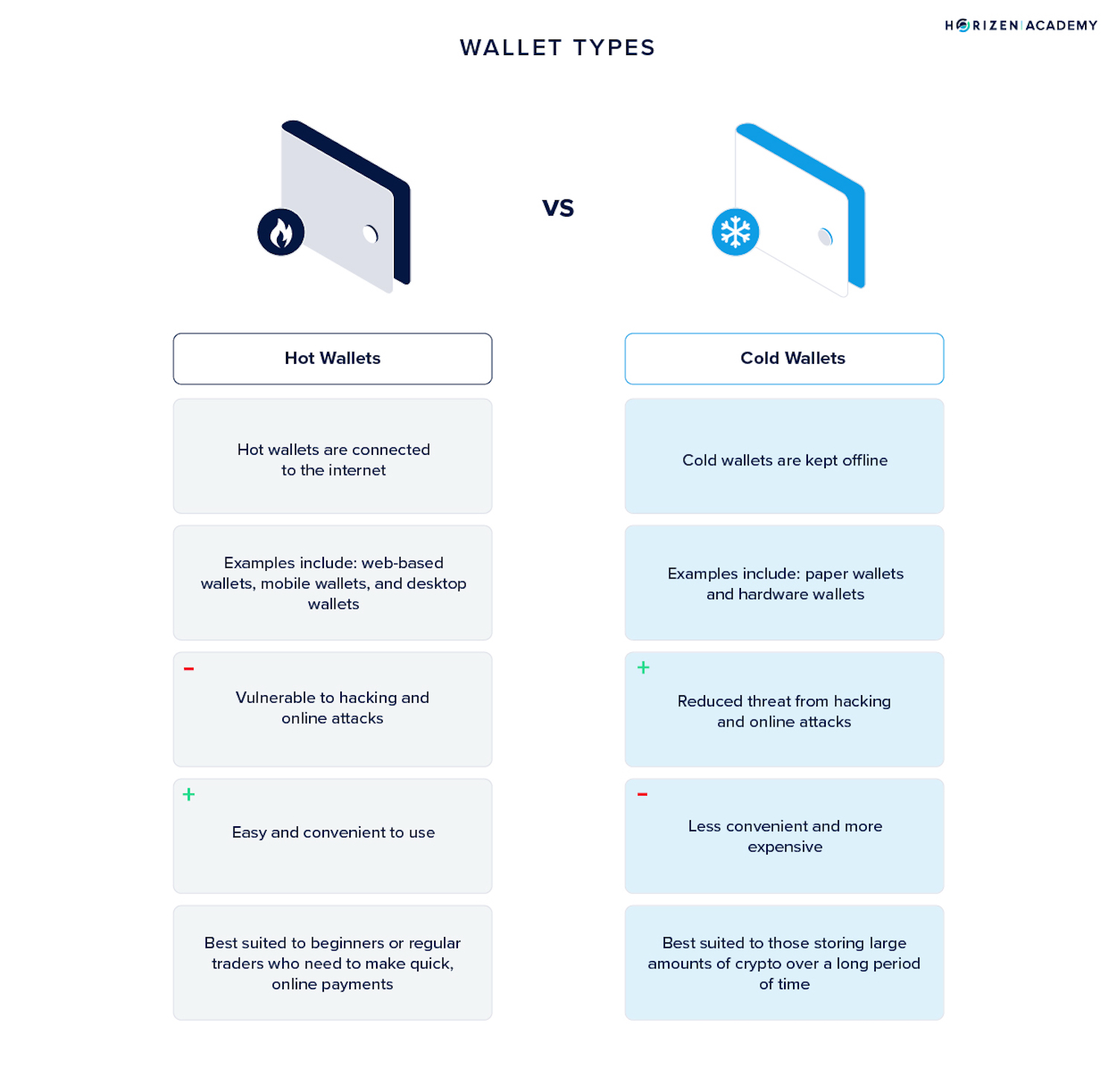

When it comes to self-custodying cryptocurrencies, there are 2 types of storage methods:

Hot Wallets and Cold Wallets.

Hot Wallets vs. Cold Wallets

Hot wallets are essentially digital wallets like a mobile wallet, web browser extension wallet or desktop wallet that are connected to the internet.

These wallets allow you to instantly deploy assets unto dapps by using your private key to authorize your funds to be spent by the dapps smart contract.

Metamask, Coinbase wallet and Trust wallet are all examples of hot wallets that are always connected to the internet.

While hot wallets make it easier for users to store and use their crypto assets on different dapps for trading, buying NFTs and more, the downside is that you are at greater risk of losing your funds due to an online hack or a bug in the wallet or smart contract you interact with.

When using a hot wallet, a hack can potentially occur anytime you sign a transaction and approve a smart contract to spend tokens from your wallet. If the contract is malicious, you could accidentally grant it permission to drain all of your funds.

Also, the process of signing into your hot wallet requires you to type a password or seed phrase into a browser window, which is a potential attack vector that could be exploited by hackers using fake website URLs to mislead you into entering your personal information.

Keeping your wallet connected to the internet means that the wallet service provider may not be able to keep the service running if the internet temporarily shuts down, or an infrastructure service provider like AWS were to experience downtime, which could impact your ability to access your funds.

For these reasons, it is normally advised that users only keep a small amount of their crypto assets in hot wallets, while the majority get stored in cold wallets.

With cold wallets, your crypto is stored on a hardware device like a USB and you don’t need to access the internet in order to send or receive crypto.

Cold wallets are generally considered to be more secure because a bad actor has to physically steal your device in order for them to steal your funds.

With hot wallets, anyone on the internet could potentially steal your funds while it is online, especially if you are signing a transaction to approve spending of tokens by a dapps smart contract, which may be faulty or maliciously set up to withdraw funds without your permission.

When using a cold wallet, a transaction is first signed from within the device itself. It must then be connected to the internet before this transaction can be broadcast to the blockchain network and confirmed.

This removes the possibility of interacting with a malicious smart contract because it is not able to directly connect to your hard wallet or authorize spending of funds. Instead, you can only use your hardware wallet to send and receive crypto.

Also, cold wallets require a special pin number to be entered before you can access the device.

This is different from the wallet's private key or seed phrase and is more like a password for the device itself.

Note that anyone who gets hold of your private key/ seed phrase can steal your funds by signing into your wallet through a different hardware device or on a browser, or a mobile wallet.

Always keep your private key/seed phrase secure and never share it with anyone!

Types of Cold Wallets

While most cold wallets are stored on a USB drive, you can also use alternative cold storage solutions such as paper wallets or physical Bitcoins.

A paper wallet is simply a printed piece of paper containing both the public and private key of a wallet, as well as a QR code to instantly port that information over to another device using a camera.

To create a paper wallet, all one has to do is create a private key using a private key generator:

- Click ‘Paper wallet’ or ‘Brain wallet’ - the site will tell you to create a password.

- Once you've created a password, it will generate a public key which is associated with the private key you created.

- You can then print these details out on paper and store it offline as your paper wallet.

The risks with paper wallets are that they are much easier to lose, can quickly deteriorate, and may produce private keys that are not sufficiently random enough to avoid a hacker discovering them through random guessing.

Physical Bitcoins are similar to paper wallets except rather than a piece of paper, they are metal coins that store the private key of a wallet underneath a tamper proof sticker or hologram.

People typically purchase these just for the novelty of owning a physical Bitcoin or physical version of some other cryptocurrency.

Though both of these alternatives are mostly outdated, they can still provide you with a secure way to store your crypto offline.

However, hardware wallets are the preferred methods for cold storage of crypto assets.

Cold Wallets Brands

The most popular cold wallets brands, include:

| Name | Purchase Cost | Supported Coins | NFT Support? |

| Ledger Nano X | $175 | BTC, ETH, XRP, BCH, DOT, LTC, TRX, EOS, XLM, ADA, etc. | Yes |

| Trezor Model T | $195 | BTC, ETH,USDT,ADA, XRP, DOGE, LTC, XMR, etc. | Yes |

| Ledger Nano S | $59 | BTC, ETH, XRP, BCH, DOT, LTC, TRX, EOS, XLM, ADA, etc. | Yes |

| ELLIPAL Titan | $139 | BTC, ETH, LTC, XRP, XLM, BNB, USDT, TRX, DOT, etc. | Yes |

| CoolWallet Pro | $149 | BTC, ETH, LTC, XRP, XLM, BNB, USDT, TRX, Tezos, Cardano, ETH 2.0, and ERC20 tokens. | Yes |

| Safepal S1 | $49.99 | BTC, ETH, XRP, LTC, XLM, TRX, DOGE, DOT, POLYGON, ADA, etc. | Yes |

| Keystone Pro | $169 | BTC, ETH, Tether, XRP, Bitcoin Cash, DOT, LTC, Kucoin, etc. | Yes |

| Keepkey | $190 | Bitcoin, Bitcoin Cash, Bitcoin Gold, DASH, Dogecoin, Namecoin, Ethereum, Litecoin, etc. | Yes |

How to Set Up a Hardware Wallet?

There are several resources available to show how to set up a cold hardware wallet in detail.

The general sequence for setting up a hardware wallet is as follows:

- Get a hardware wallet from a verified vendor

- Always ensure that you are purchasing your hardware wallet from the company's website. Do not purchase one from Amazon or other resellers.

- Once you have received an opened device, install the custom software for the device on your computer or phone

- For the Ledger Nano, users are typically prompted to install Ledger Live, which is an app that allows them to view and trade crypto assets that are stored in their hardware wallet

- Initiate your device

- To initiate your device, you need to first set up a pin code and the seed phrase. There should be instructions on your device manual for how to complete your pin code setup.

- Once the pin code is set up, you can either restore an existing wallet by typing in your seed phrase from that wallet, or you can create a new wallet with a new seed phrase.

- If you choose to create a new wallet, you should write down your seed phrase and store it in a secure location where it will not be accessible by anyone. Most hardware wallets typically come with a small recovery phrase notebook for you to write down your seed phrase. Use this and then store it somewhere safe.

- Install applications

On the Ledger Nano, once you have set up your seed phrase, you will need to install apps for managing different cryptocurrencies and tokens on your wallet.

When Should You Use a Cold Wallet?

A cold wallet can serve as a more secure alternative for storing your crypto assets if you do not need to spend or transfer them frequently, or if you are stationed in one location and don’t travel to places where you need to use crypto.

Many people choose to store their cold wallets in safety deposit boxes at a bank where items can be insured against theft or damage.

These alternatives can enable you to leverage legal protections that are otherwise unavailable when your crypto is stored on a wallet.

In addition, if you are uncertain about the strength of your internet or computer’s security, it is best to consider a cold wallet for storing your crypto until you can find a more secure computer or connection to access your hot wallet.

Ultimately cold wallets provide a convenient way for crypto users to separate the funds they wish to hodl for the long term from those that they want to actively use to interact with NFT marketplaces, blockchain games, DeFi protocols or other kinds of dapps.

The more of your crypto that is stored offline, the better you can manage the risks that come with interacting with different dapps and chains, many of which are very new and may not be fully secure.

A cold wallet can help you ensure that your crypto remains in your custody throughout any kind of market volatility or on-chain hacking incidents, allowing you to survive through to the next bull cycle and enjoy the spoils of being a long term hodler!